Big Picture: India a global economic powerhouse 2023 roundup

As 2023 comes to a close, India stands at a pivotal juncture in its economic journey, marked by significant developments that position the country for rapid growth in 2024.

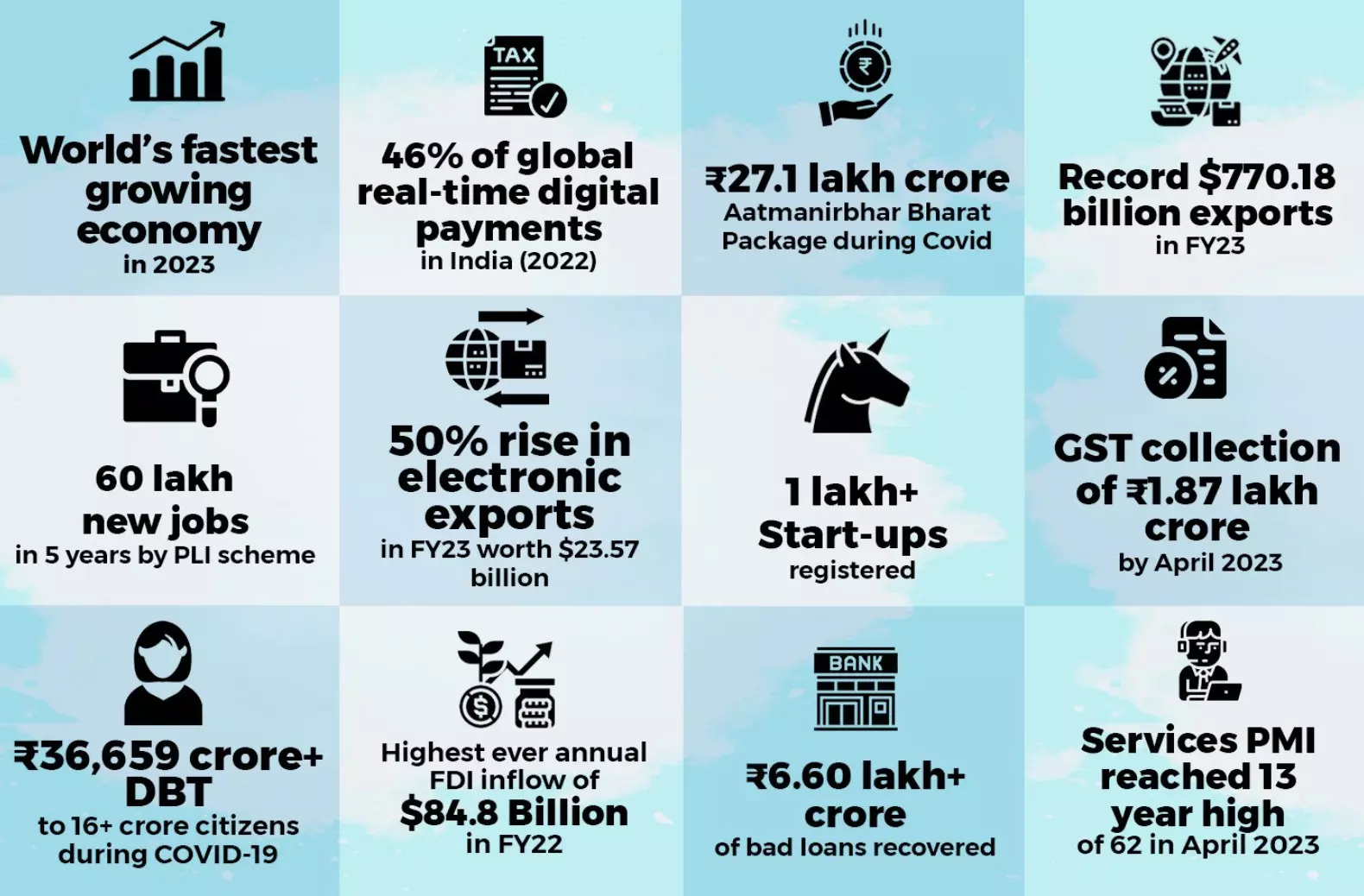

image for illustrative purpose

As 2023 comes to a close, India stands at a pivotal juncture in its economic journey, marked by significant developments that position the country for rapid growth in 2024. After achieving milestones such as a successful moon mission and hosting the G20 Summit, India is garnering increased stability and optimism for its economic prospects. This has solidified its standing as an attractive investment destination, driven by factors like its large-scale operations, skilled talent pool, and technological innovation prowess.

Industrial Manufacturing and Infrastructure Development

One notable area of growth is the industrial manufacturing sector, experiencing a considerable boost that has attracted global technology giants such as Apple seeking to expand their supplier networks within India. This momentum is reinforced by state industrial policies and sector-specific incentive schemes. Simultaneously, substantial investments in logistics and infrastructure development, including roads, highways, and rail tracks, underscore the government's commitment to strengthening this critical sector.

India's strategic emphasis on reducing logistics costs aligns with its ambition to become a key player in global supply chains, aiming to achieve a $5 trillion economy by the end of 2025. Looking ahead, India envisions attaining developed economy status by 2047, signaling a clear trajectory towards sustained growth and development.

Macroeconomic Indicators

Examining key macroeconomic indicators at the end of 2023 provides insights into India's economic performance:

1. State of the Economy:

India, with a GDP of $3.75 trillion, ranks as the fifth-largest economy globally.

Per capita income, according to government data, reached INR 98,374 (approximately $1,183) in 2022-23.

Reserve Bank of India Deputy Governor Michael D Patra projects the Indian economy to hit $5 trillion by 2027, citing developments in the financial sector and demographic advantages.

2. GDP Growth:

Real GDP growth reached 7.6 percent in the July-September quarter of 2023, surpassing expectations.

The IMF forecasted India's real GDP to exceed 6 percent in 2023 and 2024, outpacing China's growth.

3. Stock Market:

India's Nifty 50 index achieved a 16 percent increase in 2023, making it the seventh-largest stock market globally with a market capitalization of $3.989 trillion.

High-performing sectors for 2024 are predicted to include banking, healthcare, and energy.

4. Manufacturing PMI:

S&P Global India Manufacturing PMI rebounded to 56.0 in November 2023, marking the 29th consecutive month of expansion in factory activity.

Growth in new orders, foreign sales, employment, and infrastructure sectors contribute to the manufacturing sector's positive outlook.

5. Government Spending:

Government spending rose by 12.4 percent in the July-September quarter, following a contraction in the April-June quarter.

Record capital expenditure plans focus on building roads, highways, power plants, regional connectivity, and affordable housing projects.

6. Investment Climate and PLI Program:

India's emphasis on infrastructure and logistics connectivity, coupled with streamlined bureaucracy, attracts global multinational corporations.

Production-linked incentive (PLI) schemes, particularly in the electronics manufacturing services (EMS) sector, contribute to growth, with Apple experiencing significant year-on-year growth.

China Factor and Policy Measures:

India's efforts to attract foreign investment align with the 'China Plus One' strategy, aiming to diversify production and sourcing beyond China.

National security concerns and addressing trade imbalances lead to measures restricting Chinese investments, requiring equity partnerships and local manufacturing.

Bureaucracy Reforms:

Ease of doing business reforms focus on digitizing regulatory compliance processes, reducing compliances, and decriminalizing legal provisions.

India positions itself as a leader in global trade facilitation, achieving a score of 93.55 percent in 2023, emphasizing initiatives like Turant Customs and the Single Window Interface for Facilitation of Trade (SWIFT).

FDI Inflow and Dealmaking:

Foreign direct investment (FDI) experiences a decline in 2023, impacting India's position, yet Maharashtra, Delhi, Karnataka, Telangana, and Gujarat attract the highest FDI.

India-focused mergers and acquisitions (M&A) activity witnesses a significant drop, while startup funding declines to $7 billion, with a focus on artificial intelligence-driven products and services.

Trade:

Services exports are projected to reach $192 billion, aiming for $400 billion by the end of 2023-24, with sectors like telecom, computer, information, transport, and travel leading the way.

Combined exports of merchandise and services show negative growth, but sectors like iron ore, electronic goods, and pharmaceuticals exhibit positive trends.

India's economic landscape in 2023 reflects a resilient and dynamic trajectory. Despite challenges in FDI inflows and startup funding, the nation's strategic focus on infrastructure development, manufacturing, and global integration positions it for sustained growth in the coming years. As India continues its journey towards becoming a $5 trillion economy, these key indicators underscore the nation's commitment to fostering innovation, attracting investments, and contributing significantly to the global economic landscape.